Most credit-driven businesses don’t lose money because customers refuse to pay—they lose control because payments arrive late, inconsistently, and without visibility. Invoices slip, disputes grow, and AR teams spend their days chasing cash instead of managing it.

With the right strategy of accounts receivable management platform, AR shifts from reactive follow-ups to predictable cash flow—where credit risk, billing, and collections work together, not against each other.

What Accounts Receivable Management Really Means for Cash Flow

Accounts receivable (AR) management focuses on tracking unpaid customer invoices and maintaining healthy cash flow. As money owed by customers for goods or services provided on credit, AR appears as a current asset on the balance sheet, representing future cash inflows.

Effective accounts Receivable management ensures invoices are issued accurately, payments are monitored consistently, and risks are identified before they impact working capital.

Accounts Receivable Management Challenges That Signal It’s Time for a Better AR System

When AR isn’t managed well, that “asset” becomes unpredictable. Ask yourself:

- Are your cash flow forecasts unreliable, even when sales appear strong?

- Is Days Sales Outstanding (DSO) rising without a clear explanation?

- Are finance teams working with outdated or incomplete AR data, relying on spreadsheets and manual updates?

- Are high invoice volumes overwhelming staff, pulling them away from strategic work?

- Are customer relationships suffering due to reactive collections instead of proactive communication?

- Has leadership lost confidence in financial visibility, questioning the accuracy of AR reports?

- Is it difficult to manage different customer billing terms, exceptions, and regional rules consistently?

But effective AR management goes beyond recording invoices. It ensures:

- Customers are assessed properly before credit is extended.

- Invoices are accurate and delivered on time.

- Payments are monitored, applied, and reconciled efficiently.

- Credit and collection risks are identified early—before they impact liquidity.

When these elements break down, AR teams spend most of their time chasing payments instead of controlling outcomes.

Why AR Teams Get Stuck in a Payment-Chasing Loop

This issue is widespread, not isolated.

“The global Accounts Receivable Automation market stood at USD 3.40 billion in 2025 and is projected to reach USD 5.95 billion by 2030, growing at an 11.84% CAGR.” (source)

The growth is driven by pressure to shorten cash cycles, comply with e-invoicing mandates, and gain predictive visibility into receivables performance.

The result? The manual or fragmented AR processes are no longer competitive—or sustainable.

- Weak or Inconsistent Credit Policies

Many businesses extend credit based on habit, gut feel, or outdated customer data. Without structured credit evaluation, risk accumulates quietly.

The result? Customers with limited ability or willingness to pay are treated the same as reliable ones, increasing overdue balances and disputes.

- Late or Inaccurate Invoicing

Late or inaccurate invoices are one of the most overlooked causes of slow payments. Missing documentation, misaligned terms, or delayed delivery push invoices into dispute before collections even begin.

By the time AR follows up, the invoice is already “problematic” in the customer’s system.

- Manual Tracking and Fragmented Data

In many mid-sized organizations:

- Invoices live in accounting software

- Customer notes sit in emails or CRMs

- Payment status is tracked in spreadsheets

Without centralized customer and invoice history, collections become manual, repetitive, and inconsistent.

- Reactive Follow-Up Processes

Most AR teams rely on calendar reminders, generic emails, and individual judgment. Without risk-based prioritization or escalation paths, collections turn into constant firefighting.

- Poor Visibility Into Performance Metrics

As invoice volume increases, manual AR processes collapse under their own weight. The symptoms are clear:

- Aging reports grow but don’t improve outcomes

- Finance teams spend more time reconciling than analyzing

- Errors increase as volume increases

Modern CFOs increasingly tie AR performance directly to working-capital KPIs. Organizations using predictive analytics report payment-date forecast accuracy above 90%, replacing guesswork with data-driven prioritization.

In uncertain markets, faster cash conversion directly reduces borrowing costs—making AR a strategic lever, not just an operational task.

The Complete Accounts Receivable Management Process: From Credit Approval to Cash Application

High-performing finance teams don’t eliminate late payments—but they reduce uncertainty and regain control.

- Credit Workflow Management: Control Risk Before Invoices Go Out

A mature AR strategy treats credit as a financial product. Effective workflows include:

- Standardized credit approval across all customers

- Ongoing credit reviews based on payment behavior

- Clear escalation paths when limits are breached

- Compliance with federal and state credit regulations

Outcome: Fewer bad debts, faster approvals, and credit extended only where it protects revenue—not threatens it.

- Streamlined Cash Flow Management: Know Where Your Money Is

AR management gives finance leaders a real-time picture of:

- How much cash is tied up in receivables

- Which customers consistently pay late

- Where credit exposure exceeds limits

By recording and tracking every credit sale systematically, accounts receivable management teams prevent overextension and ensure enough liquidity to support daily operations.

Outcome: Stable cash reserves and fewer surprises during payroll, inventory purchases, or growth investments.

- Improved Customer Relationships Through Transparency

Late follow-ups, inconsistent messaging, and invoice errors damage trust.

A transparent AR system ensures the following:

- Timely, accurate invoicing

- Clear payment status visibility

- Documented communication history

Outcome: Customers trust your process—and pay faster because confusion is removed.

- Accurate Bank Reconciliation: Less Cleanup, More Control

Handling multiple remittance formats, missing references, and partial payments manually drains AR productivity. Automated matching of payments to invoices reduces errors, flags exceptions, and speeds close cycles.

Outcome: AR teams spend less time sorting payments and more time improving collection performance.

- Faster, Smarter Invoicing & Tracking

Well-built AR systems:

- Send invoices immediately after delivery

- Track invoice status in real time

- Support multiple payment methods (ACH, cards, drafts)

Outcome: Faster invoice delivery with easier payments shortens DSO.

- Effective Deduction & Dispute Management

Centralized dispute tracking and structured resolution prevent deductions from stalling cash flow.

Outcome: Lower Days Deduction Outstanding (DDO) and faster dispute resolution.

What to Look for in an Accounts Receivable Management System for Mid-Sized Businesses

Cloud-based accounts receivable management solutions now account for 81.2% of the market, growing at a 16.8% CAGR, driven by faster deployment, built-in compliance, and reduced IT reliance—especially for mid-sized businesses. (source)

Did you know that mid-sized companies using intelligent AR platforms typically cut DSO by ~7 days and achieve 95% straight-through cash application, even in high-volume industries? (source)

For mid-sized businesses operating in the U.S. and international markets, an effective AR system should offer:

- Support for both balance-forward and open-item customers

- Flexible credit terms and billing structures

- Detailed aging summaries and customer histories

- Automated cash application and finance charges

- Strong reporting and audit visibility

- Integration with broader accounting and ERP systems

Overall, AR automation helps mid-sized businesses reduce DSO by 15–30% within the first year, unlocking significant working capital. (source)

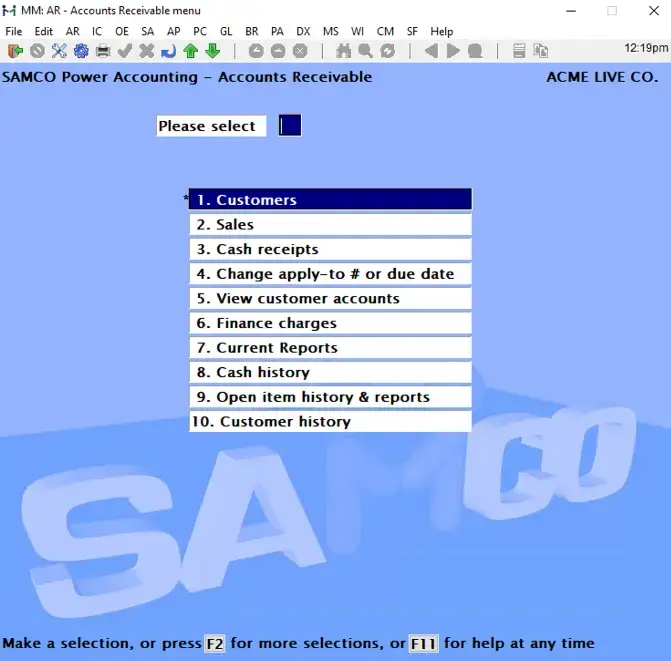

A Thoughtful Recommendation: The SAMCO Approach

Rather than treating accounts receivable management as a task, SAMCO Accounts Receivable positions it as a cash-flow control system.

- Why SAMCO Works for Mid-Sized Businesses

As AR platforms evolve toward AI-native, workflow-driven systems, buyers increasingly value control, clarity, and reliability over experimental complexity. SAMCO’s Accounts Receivable module aligns with this shift by focusing on:

- Supports both balance-forward and open-item customers

- Flexible credit terms, proximo billing, and net terms

- Automated aging summaries and finance charges

- Centralized customer notes and history

- Clean integration with broader accounting and ERP workflows

A distributor managing 4,000+ invoices monthly reduced DSO within two billing cycles after implementing SAMCO—gaining visibility, accuracy, and control.

FAQS

- What is accounts receivable management?

It’s the process of controlling credit sales, invoicing, collections, and cash application to ensure predictable cash flow.

- Why does poor AR management hurt cash flow?

Late invoicing, weak credit controls, and manual follow-ups delay payments and increase working-capital risk.

- How can AR automation reduce DSO?

By prioritizing at-risk invoices, automating reminders, and accelerating invoice-to-payment cycles.

- Is AR automation only for large enterprises?

No. Mid-sized businesses often see faster ROI due to lean teams and higher manual effort.

- When should a business upgrade its AR system?

When DSO rises, visibility drops, or invoice volume outgrows manual processes.

Conclusion: From Chasing Payments to Predictable Cash Flow

If your accounts receivable management team is always chasing payments, it’s rarely a people problem. It’s a process and system problem. With the right approach and tools, accounts receivable stops being a constant source of stress—and becomes a reliable driver of financial stability.

Ready to take control of your cash flow? Explore how SAMCO SOFTWARE INC. accounts receivable software helps mid-sized businesses reduce DSO, improve visibility, and manage credit with confidence—request a demo or speak with a SAMCO expert today.